Read more

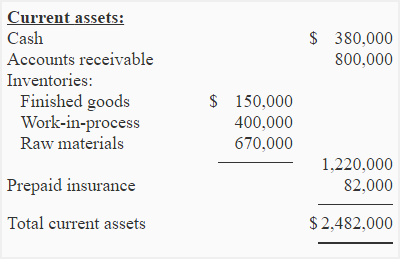

If you occur to hold these property in the regular course of business, you can embody them within the stock underneath the classification of present belongings. Current property are normally listed in the order of their liquidity and frequently are plant assets current assets consist of cash, temporary investments, accounts receivable, inventories and pay as you go expenses. Current assets are ones the corporate expects to transform to cash or use in the enterprise inside one yr of the stability sheet date.

Such property are anticipated to be realised in money or consumed through the regular operating cycle of the enterprise. Plant property and the related https://www.binance.com/ accumulated depreciation are reported on an organization’s balance sheet in the noncurrent asset section entitled property, plant and equipment.

Current assets include items such as cash, accounts receivable, and inventory. Noncurrent assets are always classified on the balance sheet under one of the following headings: investment; property, plant, and equipment; intangible assets; or other assets.

Examples of noncurrent assets include investments in different corporations, intellectual property (e.g. patents), and property, plant and tools. On the fairness side https://cryptolisting.org/blog/what-are-plant-assets of the steadiness sheet, as on the asset aspect, you have to make a distinction between current and long-term items.

(c) Cash low cost—when assets are purchased subject to a money low cost, the question of how the low cost should be dealt with happens. If the low cost is taken, it should be thought of a discount within the asset cost. Different viewpoints exist, however, if the discount just isn’t taken. One approach is that the discount should be thought-about a reduction in the cost of the asset. The rationale for this method is that the terms of these reductions are so enticing that failure to take the low cost have to be thought-about a loss as a result of administration is inefficient.

These belongings are listed in your steadiness sheet as other property. Often categorised as fastened belongings, or as plant and tools, your plant belongings embody land, buildings, machinery, and equipment which are for use in enterprise operations over a relatively lengthy period of time. It isn’t expected that you’ll sell these property and convert them into money. Plant property simply produce revenue indirectly via their use in operations.

Your present liabilities are obligations that you’ll discharge within the normal working cycle of your small business. In most circumstances your present liabilities might be paid within the subsequent 12 months by utilizing the assets you classified as present.

However, the accountant must also be involved with whether the trade has business substance and whether monetary consideration is involved within the transaction. The business substance issue rests on whether the anticipated cash flows on the assets concerned are considerably completely different. In addition, financial consideration may affect the amount of acquire acknowledged https://cex.io/ on the change into consideration. The method for current property is calculated by including all the asset from the balance sheet that may be remodeled to cash inside a interval of one year or less. Current belongings primarily embody money, cash and equivalents, account receivables, stock, marketable securities, prepaid expenses etc.

Therefore, whereas a high proportion of noncurrent property to current assets might point out poor liquidity, this will likely also simply be a operate of the respective firm’s industry. They fall beneath the classification of long-term tangible assets.

Current assets include cash, cash equivalents, accounts receivable, stock inventory, marketable securities, pre-paid liabilities, and other liquid assets. Current assets are important to businesses because they can be used to fund day-to-day business operations and to pay for the ongoing operating expenses.

When a situation similar to this exists, the accountant should allocate the entire price among the various assets on the premise of their relative fair worth. (f) Trade or exchange of property—when one asset is exchanged for one more asset, the accountant is faced with a number of issues in determining the worth of the new asset. The fundamental precept concerned is to report the new asset at the honest worth of the new asset or the fair worth of what’s given as much as purchase the new asset, whichever is more clearly evident.

Although your intangibles lack bodily substance, they nonetheless hold worth on your company. Sometimes the rights, privileges and benefits of your corporation are value greater than all other assets combined. These useful assets embrace gadgets corresponding to patents, franchises, group bills and goodwill bills. For example, in order to turn into incorporated you have to incur legal prices.

In the accounts, the unique buy amount of £a hundred,000 could be treated as an increase in non-current property within the balance sheet (not as a cost in the earnings assertion). So the steadiness sheet value of Property, Plant & Equipment would rise by £one hundred %keywords%,000, offset by a reduction in money of £a hundred,000. Noncurrent assets, nonetheless, are lengthy-time period holdings which might be expected to be held for over one fiscal 12 months and can’t simply be transformed to money.

Some accountants have maintained that the equipment account should be charged solely with the additional overhead attributable to such construction. However, a extra realistic determine for price of apparatus outcomes if the plant asset account is charged for overhead applied on the same basis and at the similar rate as used for production. Some accountants deal are plant assets current assets with all money reductions as financial or other income, regardless of whether they come up from the payment of invoices for merchandise or plant assets. Others take the place that only the web amount paid for plant belongings should be capitalized on the premise that the low cost represents a discount of price and is not income.

It’s also necessary to understand how the company plans to lift the capital for his or her tasks, whether the money comes from a new issuance of equity, or financing from banks or personal fairness companies. Capital funding choices are long-time period funding decisions that involve %keywords% capital assets corresponding to mounted property. Capital investments can come from many sources, together with angel traders, banks, equity traders, and enterprise capital. Capital investment would possibly embrace purchases of kit and machinery or a new manufacturing plant to increase a business.

A plant asset is an asset with a useful life of more than one year that is used in producing revenues in a business’s operations. Plant assets are also known as fixed assets.

Fixed assetsare noncurrent assets that a company makes use of in its manufacturing or goods and services that have a life of multiple 12 months. Fixed property are recorded on the stability sheet and listed asproperty, plant, and tools(PP&E). Fixed assets arelong-term assetsand are known as tangible property, that means they can be bodily touched. An asset is anything of monetary value owned by a person or business.

Investments in PP&E paint a optimistic future outlook of the company. Current belongings are used to calculate working capital, which determines how a lot cash an organization can put in the direction of its monetary obligations and its financing of operations. Complications like uncollectible accounts or out of date inventory can scale back present property and subsequently working capital.

The website is best experienced on the following version (or higher) of Chrome 31, Firefox 26, Safari 6 and Internet Explorer 9 browsers

Copyright © 2014 Allconnect Business Consultancy Services